Railway Siding Charges Circular

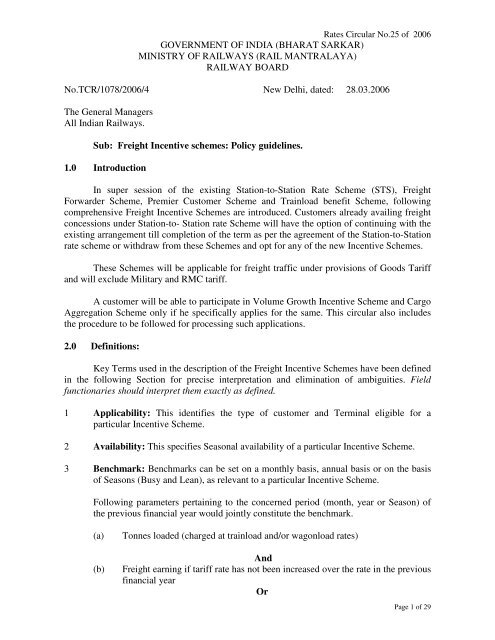

Haulage charges recoverable for movement of milk traffic in railway milk tankers rmt owned by private parties.

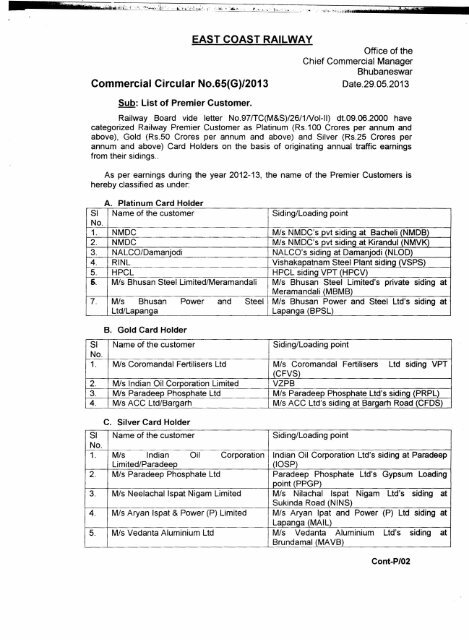

Railway siding charges circular. 99 tc fm 26 1 pt ii vol i policy circular on private sidings freight marketing circular no. Levy of surcharge on bogibeel rail cum road bridge over nfr. Freight rate for transportation of 4 no s. All zonal railways rates circular no.

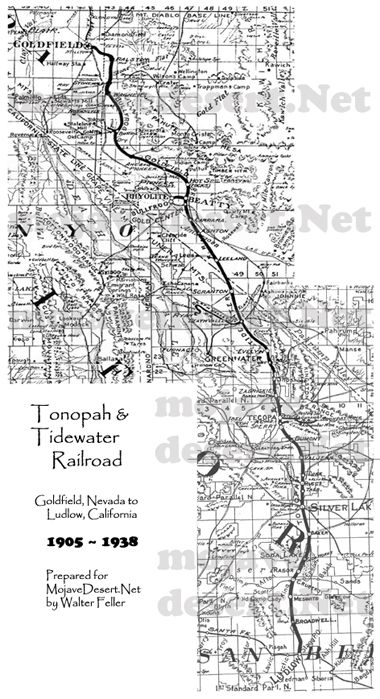

Law with respect to railway sidings. Different types of sidings include public sidings owned and operated by railways assisted sidings private sidings departmental railway siding military siding etc. 2 1 1 major audit findings. 8w ohes tower wagons from beml bangalore siding to.

Fixation of siding charge a clarification has been sought regarding fixation of siding charge in the case. 19 of 2011 government of india ministry of railways railway board new delhi bt24 05 2011 2 0 3 0 4 0 5 0. Circular is amended dated 17 01 2008 as 2 3 rate of stabling charge will be rs 300 per wagon per day or part of a day from the time of arrival to the time of removal. All india engine hour cost aiehc for recovery of siding and shunting charges.

Policy circular on private sidings. Coaching train captain as overall leader and in charge of all on board railway personnel and outsourced staff. 1 of 2012 on siding matters liberalization of siding rules. Railway sidings defence siding agreement.

Container rail terminal methodology for levy terminal access charge. Following the law relating to railway. Rates circular no 16. Clarification to para 4 4 iii of f m.

2 5 when privately owned stock is detained in the private siding or in a railway siding meant for handling such stock no stabling demurrage charge will be levied. One time charges for 10 years. More than 75 of freight traffic is handled in sidings. Recovery of maintenance charges and inspection charges for private siding.

Rates master circular crt ccr hub spoke 2015 0 its corrigenda addendum. Transportation of relief material to flood affected areas of jammu kashmir state free of charge. Validity will be as per the rates circular under reference. Railways during 2009 2014 on the aspects pertaining to private siding operations that included setting up new sidings operation of the new as well as existing sidings and recovery of various charges from the siding owners besides closure of sidings not in operations.

In 2012 mega exemption notification 25 2012 service tax dated 20 06 2012 was issued which resulted in the confusion regarding the activities related to private railway sidings that whether the activity related to private railway sidings are liable for service tax or not. All indian railways sub.